News

Recent News

From January 5, 2026, the Register of Apartment Owners’ Associations is available in BIS

Published Tuesday, 06 January 2026Significant amendments to the regulatory framework will enter into force from the New Year

Published Monday, 29 December 2025Regulation adopted to launch the unified construction process from the New Year

Published Tuesday, 16 December 2025From January 1, 2026, the minimum wage in construction

Published Monday, 15 December 2025For annual information renewal in the Register of Construction Merchants and filling out the company's annual report

Published

Monday, 29 April 2024

Published

Monday, 29 April 2024

The State Construction Control Bureau of Latvia (SCCB) reminds that as of 01.01.2024, the procedure for annual information update has been changed (amendments of 13.07.2023 to Cabinet Regulation No. 116 "Regulations Regarding the Registration of Construction Merchants").

For construction merchants (except foreign merchants and individual construction merchants), annual information submissions are no longer required (neither in forms nor in BIS e-services).

The procedure for processing annual information data and payment of state fees from May 1, 2024:

- SCCB will automatically receive annual information data of merchants (LLC/SP/JSC/PC) from the State Revenue Service (SRS) via the Electronic Declaration System (EDS) registered company's annual financial statement profit or loss calculation (net turnover (R10) / revenue from construction services (R25)).

- After receiving annual information data from SRS EDS, by September 30, SCCB will calculate the state fee for inclusion of annual information in the Register of Construction Merchants, prepare an invoice, and send it to the construction merchant.

- Invoices will be available in the construction merchant's BIS profile and the construction merchant's email.

- The deadline for payment of state fees is November 30.

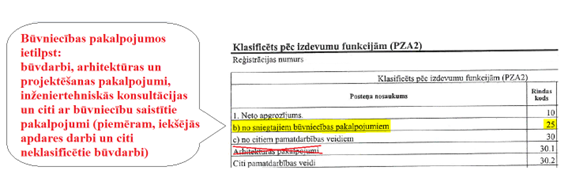

It is especially important to remember that in order for the state fee to be calculated from income from construction services, the following must be indicated in the SRS EDS annual report PZA:

- net turnover (R10);

- revenue from construction services (R25).

If a construction merchant has only carried out construction work for their own needs, it is mandatory to indicate a value of 0 EUR in the annual report PZA R25. If a value of 0 EUR is not indicated, then the fee will be calculated based on the merchant's total net turnover.

Meanwhile, foreign merchants and individual merchants submit annual information to SCCB regarding the construction merchant's activities in the previous calendar year using BIS e-services from May 1 to August 31.

CONSTRUCTION MERCHANTS are excluded from the Register of Construction Merchants if:

- the merchant has not submitted the SRS EDS annual report (information about the construction merchant's activities in the previous calendar year will not be received in the Construction Merchants Register, and no invoice will be generated);

- Until November 30, the state fee invoice has not been paid into the State Treasury account LV33TREL1060120929200 or has been paid incompletely.

The information was translated using the ChatGPT service.