News

Recent News

From now on, wooden buildings can be built taller and larger.

Published Tuesday, 09 December 2025The Saeima establishes a single application for construction and property registration.

Published Friday, 14 November 2025The apartment owners’ association will be able to receive loans for the renovation of residential buildings.

Published Thursday, 13 November 2025Due to technical issues at LVRTC, the operation of the BIS has been affected

Published Thursday, 13 November 2025Regarding the completion of the annual report and updating of annual information in 2024

Published

Thursday, 14 March 2024

Published

Thursday, 14 March 2024

The information was translated using the ChatGPT service.

The State Construction Control Bureau (SCCB) informs that as of January 1, 2024, the procedure for updating annual information has been changed (amendments of July 13, 2023, to Cabinet Regulation No. 116 of February 25, 2014, "Regulations for Registration of Construction Merchants" (hereinafter - Regulation No. 116).

Construction merchants (except foreign merchants and individual construction merchants) no longer need to submit annual information submissions, because in 2024 the processing of annual information data will be initiated automatically from May 1 (until May 1, this e-service is closed).

The new procedure for updating annual information for construction merchants is as follows:

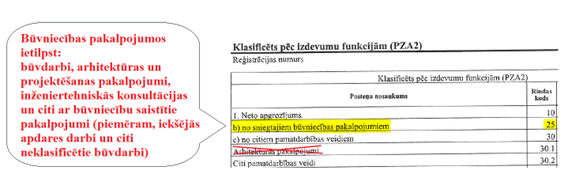

- Annual information data of the SCCB merchants (SIA, PS, KS, A) will be received automatically from profit or loss account of the company’s annaul report submitted to the State Revenue Service (SRS) in the Electronic Declaration System (EDS) (PZA net turnover/PZA R25).

- After receiving annual information data from SRS, the SCCB will calculate state fees for including annual information in the Register of Construction Merchants by September 30, prepare an invoice, and send it to the construction merchant.

- Invoices will be available in the construction merchant's profile in BIS and sent to the construction merchant's email. The deadline for payment of state fees is November 30.

Foreign merchants and individual merchants must submit annual information to the SCCB once a year from May 1 to August 31 using the BIS e-service, for the previous calendar year.

The state fee for including annual information in the Register of Construction Merchants will be calculated based on the net turnover indicated in the annual report received from SRS and the construction revenue volume indicated in PZA R25.

The SCCB reminds that when filling out the annual report in SRS EDS, merchants must indicate:

If a construction merchant has carried out construction work only for his own needs, then the value of 0 EUR must be indicated in the annual report's PZA R25. If the value of 0 EUR is not indicated, then the fee will be calculated based on the merchant's total net turnover.

! Note: According to Regulation No. 116, point 22.2, construction merchants will be excluded from the register if data on annual information is not received or if the state fee is not paid within the specified deadline or if it is paid incompletely. Additionally, construction merchants for whom data is not received from SRS will be excluded from the Register of Construction Merchants.